Published: Oct 10, 2024

GenAI solutions for contact centre operations

Improving productivity and compliance management of contact centre agents with a new generation of AI Assistants

Customer contact centres play a pivotal role across a wide array of industries, including telecommunications, banking, and the public sector. These centres serve as the front line for customer interactions, addressing queries, resolving issues, and enhancing customer satisfaction. The contact centre industry is not just widespread but also deeply globalised. Many organisations have outsourced and offshored their customer service functions to leverage cost efficiencies and access to skilled labour in various regions.

As of today, the global contact centre industry employs over 17 million people worldwide and represents a market worth US$30 billion in 2023. This expansive industry continues to evolve rapidly, driven by technological advancements, with AI poised to be a transformative force.

In this article, we explore how AI impacts contact centres in two important ways: 1) improving the productivity of the contact centre agent, by allowing the agent to not only do existing tasks better in less time, but also take on new value-adding tasks; and 2) enhancing the effectiveness of organisation to ensure the agents comply with organisation-specific policies and industry rules and regulations.

Boosting productivity

Contact centre staff perform a variety of essential tasks that ensure smooth and efficient customer interactions. Their responsibilities include answering inbound calls, handling customer complaints, processing orders and payments, and providing detailed information about products and services. In addition to managing customer accounts and scheduling appointments, they often respond to emails and live chat messages, ensuring that all customer queries are addressed promptly. They also follow up on customer requests and conduct satisfaction surveys to gather feedback for continuous improvement. Adhering to scripts and compliance guidelines, particularly in regulated industries, ensures consistency and adherence to legal standards.

With AI’s growing presence, many of these routine tasks are expected to become automated, allowing staff to focus more on complex, value-added activities. The impact of AI would vary, depending on the nature of the call centre operations to begin with.

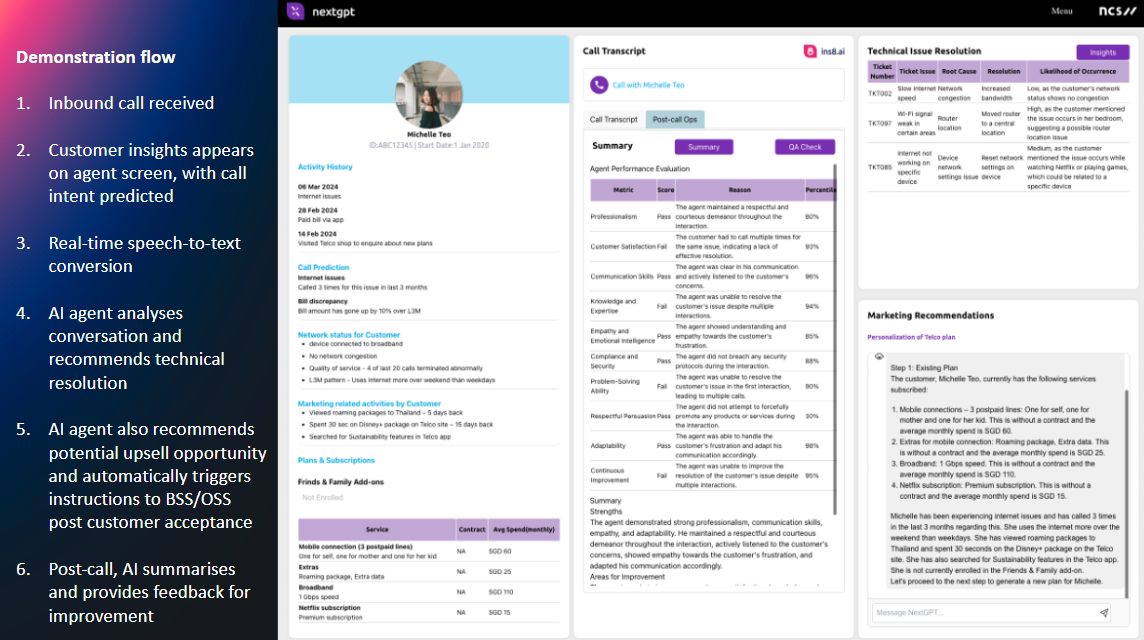

In a next-gen contact centre scenario that we envisioned with a group of Telcos, GenAI acts as an assistant to the call centre agent across the lifecycle of a call:

- Pre-call: Assist the agent with personalised questions to validate the identity of the caller

- During the call: To provide technical resolutions from historical cases and surface relevant promotions to the agent

- Post-call: Automate capture of summaries and downstream actions

Figure 1. GenAI as an assistant to the call centre agent

In a recent implementation with a 250-strong call centre in Singapore, GenAI was applied successfully to 2 key areas:

- First, the training of new call centre agents. Compared to manual trainers, the AI training assistant always has access to up-to-date knowledge base as training content, is able to produce dynamic simulation scenarios to enhance the learning experience, and can be customised to take into account the knowledge level of the trainee. As a result of the AI training assistant, the onboarding time was reduced by 14%.

- Second area is automating the after-call work. The AI summariser generates post-call summaries in standardised format for follow-ups. This has helped to cut more than half of the after-call work time, freeing up agents to take on more calls. The agent can now handle more calls, up from average of 32 to 40 per day.

The underlying technology products and services used to modernise this contact centre included AWS Bedrock cloud services, Anthropic’s Claude Instant LLM and NCS’ proprietary speech-to-text engine called Ins8.ai. With the successful implementation, the technology architecture and deployment roadmap now serve as a reference template for other similar contact centres globally.

Enhancing compliance

In the highly regulated world of financial services, banks, insurance companies and other advisory firms face significant challenges in ensuring compliance and preventing misconduct by their customer service agents or relationship managers (RMs). Manual and error-prone monitoring processes often lead to delayed detection of non-compliant behaviour, exposing banks to risks and potential penalties.

Banks and insurance companies face multiple hurdles in ensuring compliance within their organisations including a high volume of interactions, staff turnover, frequent product and policy updates, and the emergence of new regulations. The current manual approaches to compliance are insufficient to keep pace with the scale and speed of change.

Banks require large compliance teams to manually monitor just a small percentage of calls, resulting in significant latency and less-than-comprehensive oversight of non-compliant behaviour. Recent cases of personal bankers deceiving customers resulted in financial loss and damage to the banks’ reputations, and highlight the limitations of the existing approach to compliance, such as the case reported by The Straits Times on 21 Aug 2024 wherein MAS issued a 9 year prohibition order against a large ASEAN bank’s relationship manager for misconduct. Earlier this year, in Jan 2024, Bloomberg reported on the Credit Suisse AT1 bond fallout hitting a large Indian bank, where customers alleged that the bank’s relationship manager mis-sold the bonds by saying they were secure and failing to explain the risks.

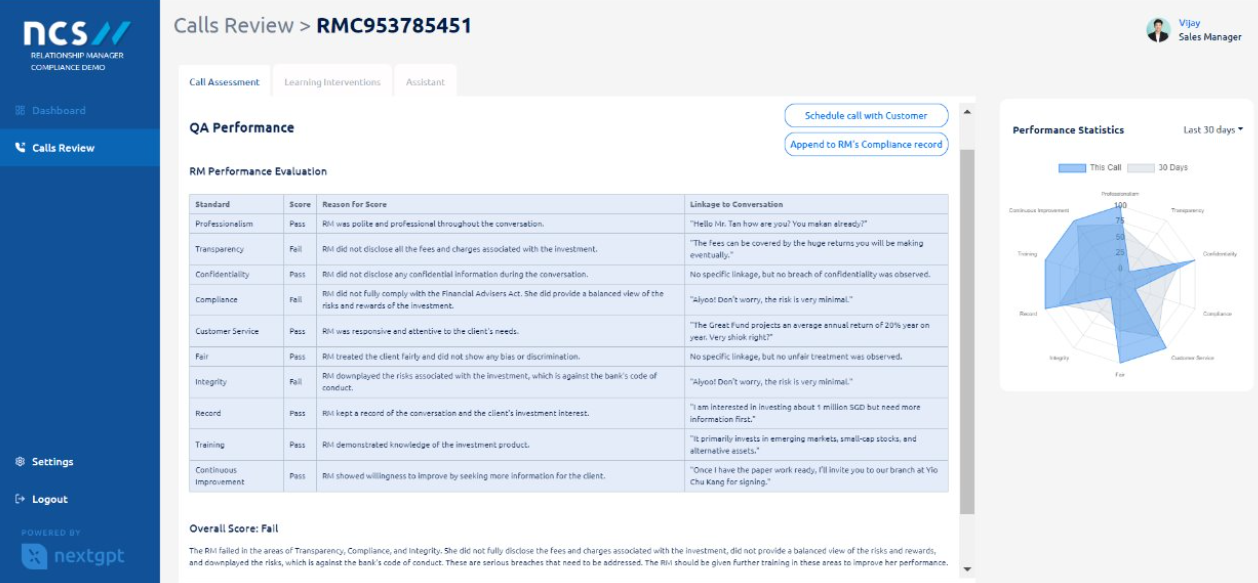

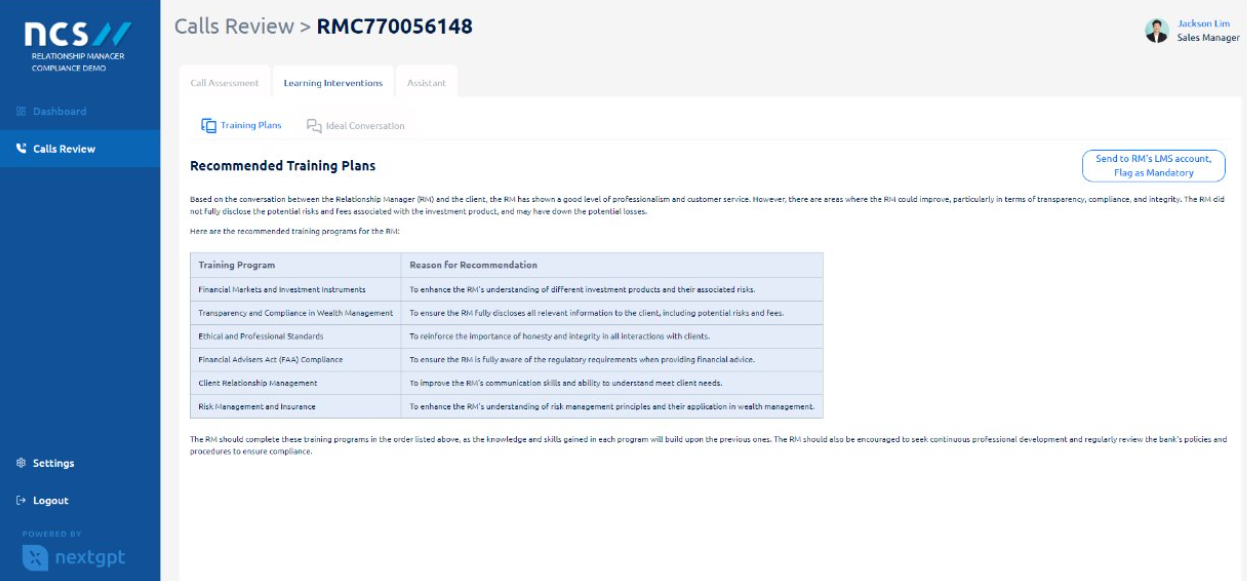

Leveraging advanced language models and automated hyperlocal speech recognition, NCS developed the Compliance AI Assistant to enable real-time monitoring, actionable insights, and enhanced performance management. This innovative solution addresses the problem statement “Is my Relationship Manager compliant with both internal and external regulatory policies and guidelines?’ and utilises real-world conversations, bank policies, ethical guidelines, and regulations (such as those of the Financial Advisers Act/MAS, in Singapore) as inputs. By combining these inputs with the power of GenAI, the Compliance AI Assistant provides real-time alerts on non-compliance, generates comprehensive reports, and facilitates targeted training plans for RMs, enabling a holistic view of RM performance (Refer to Figures 2 and 3).

Figure 2. Automated compliance check in near real-time

Figure 3. Recommended relevant learning interventions to improve agent performance

Implementing the Compliance AI Assistant and integrating it within a bank’s business processes/IT environment can lead to significant improvements in compliance metrics. The percentage of calls monitored can be increased to 100% from the current 5-10% standard, instantly reducing the 3-6 months latency observed today. Furthermore, the solution can reduce the number of manhours by 80-90%, thus streamlining the compliance monitoring process and making it more efficient.

Conclusion

The integration of AI, particularly Generative AI, into contact centre operations offers transformative benefits by significantly enhancing both productivity and compliance management. On the productivity front, AI-driven solutions enable agents to perform routine tasks more efficiently, reducing time spent on repetitive activities and freeing them to focus on more complex, value-added interactions. By automating processes such as live speech-to-text transcription, post-call summaries, and personalised training, AI allows agents to handle more calls, improve customer satisfaction, and take on new responsibilities that contribute to business growth.

In terms of compliance management, AI is a game-changer for industries like banking and insurance, where regulatory adherence is critical. The Compliance AI Assistant, for instance, provides real-time monitoring and insights, ensuring that every interaction is aligned with both internal policies and external regulations. This not only mitigates risk but also streamlines the compliance process by automating what was once a labour-intensive task. With AI, contact centres can monitor 100% of interactions, significantly reducing latency and minimising the likelihood of non-compliance. In essence, AI empowers organisations to enhance productivity while maintaining rigorous compliance standards, driving both efficiency and effectiveness in contact centre operations.